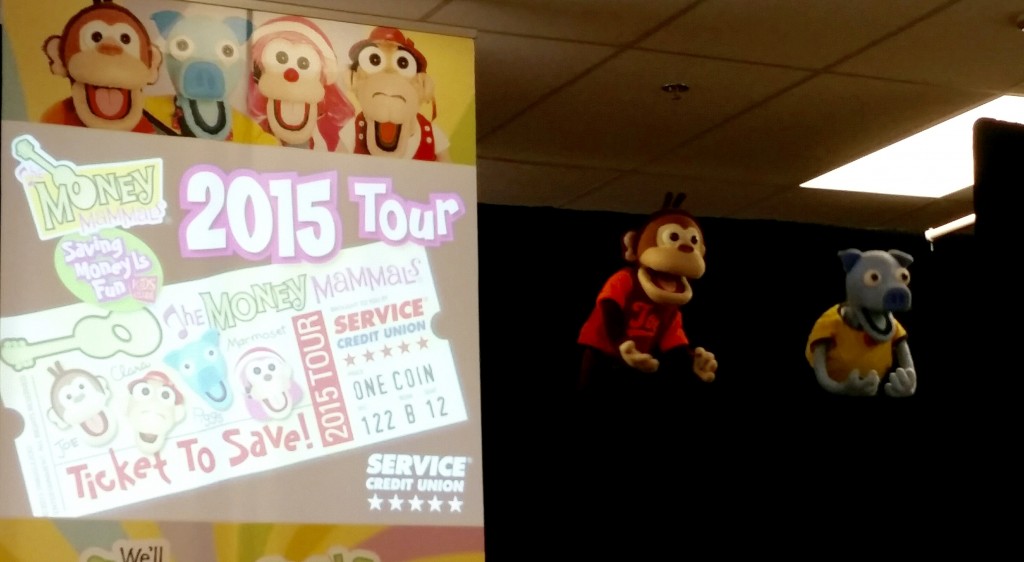

We recently returned from the second leg of our Money Mammals “Ticket to Save” tour with Service Credit Union. Take a look at the local write-up of our super-fun shows for the children of the fine men and women who reside at the Grand Forks Air Force Base.

Our shows are live multimedia events (Don’t call them just puppet shows 🙂 ) that feature our puppets as part of an interactive experience with kids. Games. Questions. Learning. Financial literacy! We actually go into local schools for these shows, as we did at Twining Elementary on the base. Our wonderful partner, Service Credit Union, is committed to financial literacy in the local communities that it serves. It knows that by exposing kids to positive money messages from a young age, they will have a better chance of becoming financially literate adults as they get older.

As I wrote in my last blog post, your mission as a credit union should be to find a way to matter. Service Credit Union’s working with The Money Mammals is doing just that by providing a hugely valuable community experience that has the potential to shape a generation when done on a large scale. Teachers and school administrators love the shows. But also think about how parents are going to feel when they find out that Service Credit Union has provided such a valuable offering to their kids. Think about how that brand is going to be seen in the eyes of those parents.

Think also about what Bernadette Jiwa, author and marketer extraordinaire, has to say as you develop your credit union marketing plan for next year: “What if, instead of spending all that time and money on deciding how to tell customers who we are, we spent more time and money on being who they want us to be?” Is your institution doing more of the former or of the latter? Are you interrupting and telling, or are you listening and being what your members and prospective members want you to be? Do you truly matter to your members and the communities that you serve? If not, it might be time to rethink your credit union marketing plan.

Thanks for listening. Let me know what you think. I’m here to listen too.

John